There has been an ongoing debate over recent years on active verses passive fund management. The obvious difference being cost but what’s the actual difference in how they are managed.

Active

The fund manager or managers add a level of expertise to a portfolio of investment which tracker fund can’t match. The use of analytical research through visiting companies, studying their balance sheets, next product line and competition allows a certain insight. The astute fund managers will be able to spot opportunities of under value companies and build a portfolio to try and ‘beat the market’.

Active fund management has long been the favourite of pension funds and their number dominate the fund landscape. There is an additional cost however due to the amount of research and people involved in building such a diversified portfolio of investments. Many believe you get what you pay for and the additional cost should result in additional performance. Clearly not all fund manager have the skill to deliver on a consistent level. In a highly competitive market where fund managers advertise their pedigree to entice potential private investors and pension fund cash, there are going to be winners and losers. Tilney Bestinvest run a bi-annual report naming and shaming the worst.

Active fund managers have the ability in volatile markets to shift assets classes or dump bad investment choices, providing additional control over passive management. In a recent example the active fund managers will have been able to quickly reduce their exposure to say Russian stocks or move sharply out of the oil sector.

A selection of active fund managers do outperform the index and their peers. Two notable ‘pop starts’ of recent decades are Neil Woodford and Anthony Bolton. Both steeling the limelight and promoting an active approach.

Passive

Whilst actively managed funds make up the majority of funds available, passive management is gathering a rapid pace. In short, these funds are still managed but rather than pick individual funds from an index the index is chosen as a whole. To use an example the FTSE 100 is the loosely the 100 most traded, most capitalised funds in the UK. An active fund manager might research them all and pick 25 they see as undervalued and with growth potential. A passive fund manager would just use the 100 companies already predetermined. This massively reduces research costs which are passed onto the investor.

The number and choice of passively managed fund is ever growing with the introduction of ETFs (exchange traded funds). These provide a cost effective route to market to invest in global indices. The obvious advantage of a lower cost base is that any returns grow the investor’s wealth rather than the fund managers. In 2004 there were only about 150 ETFs there are now around 1,300. Of the £740bn invested in funds, nearly £70bn is now invested in tracker funds according to the Investment Managers Association in May 2013.

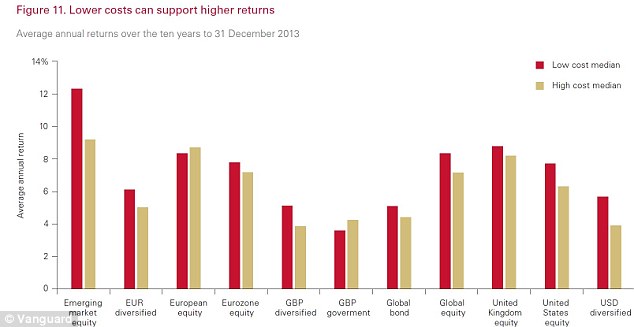

The debate is ongoing as to which is the best management style. Vanguard who are leading the passive fund management charge looked at the performance over 10 years of the two styles.

Using data from Morningstar they found that lower cost funds outperformed those with higher costs in 9 out of 11 sectors.

The debate will continue to run on which is more cost effective and ultimately more profitable. Consideration should be given to both and it will come down to your preference. Passive funds still largely operate in the more popular developed markets so if you’re looking for a niche investment portfolio this may only be served by a highly informed active fund manager.

Speak to your financial adviser about which opportunities are right for your pension drawdown portfolio.

Leave A Comment