I have many clients who want the features income drawdown provides but don’t have a high appetite for investment risk. This is either though inexperience of investing, no desire to keep an eye on investment markets in their retirement years or not having capacity for significant losses.

So what alternatives are there that offer some of the features but without risk?

To answer this question it’s important to define the risk you’re wanting to alleviate.

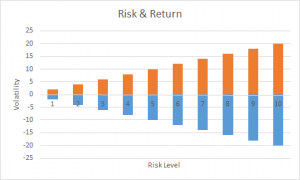

Volatility Risk

Exposing your pension fund to markets through investment funds will carry risk to capital, meaning your fund value can go both down as well as up. The amount it moves in either direction will usually be linked the overall risk level the fund aim to follow.

Think of 10 risk levels, 10 being high risk and 1 being low. A risk 10 fund will be highly volatile and may go up 20% in one year and down 20% the next. On the other end of the scale a risk level 1 fund (there are very few) may go up 2% one year and down 1% the next.

Volatility risk is therefore the amount of risk you wish to take in order to seek higher returns but with the knowledge of potential downsides.

Some people don’t want any risk to capital through volatility, that’s ok, we’ll discuss the potential options for those type of clients below.

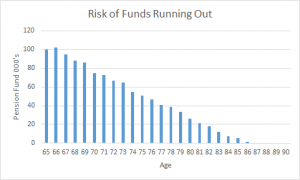

Longevity Risk

This is the risk of having a drawdown plan where the money runs out before your health does.

One of the downsides to standard drawdown is that there is no lifetime guarantee of income, unlike an annuity. You trade off flexibility to access your fund at your leisure but carry all the risk yourself that it may run out.

This is of particular concern because as a nation we are all living longer and we don’t know what age we need to budget until.

The fear of running out of money in drawdown can be compounded if the markets suffer negative returns in the early years, we’ll discuss below some potential solutions if this is of particular concern.

Drawdown with Capital Guarantees

Certain providers and funds offer a guarantee of fund value after a certain term, usually around 10 years and above. This protects the original fund value at the end of the specified term, regardless of market performance.

Therefore, if £100,000 was invested, and at the end of the term the market value reflected £80,000, the guarantee would increase the value back to £100,000 (provided no income had been taken).

If income had been taken, the original value less income could be guaranteed.

So if £10,000 income had been taken in the above example, £90,000 would be guaranteed.

This could be used for an amount of your pension fund you don’t intend to need in the next 10 years. For example, if you had a fund of £100,000 and needed £5,000 income per year, £50,000 could be earmarked with a guarantee (providing the other £50,000 was at no risk and held in cash for withdrawals).

This would provide potential for growth within an investment fund but secure the original investment should markets fail.

There are number of ways and reasons these guaranteed are used, they do come at an additional cost however. Expect to pay 0.3-0.6% more per annum for the guarantee.

Drawdown with a guaranteed income.

As discussed earlier one of the main risks of income drawdown is running out of income. This could either be from poor performance or taking too much in the early years.

Drawdown with a guaranteed income can overcome this issue.

There are a number of providers who have historically offer this solution and a couple of new ones who have entered the arena since April.

Some provider operate this by offering a lifetime income based on an initial fund value. The fund stays invested but if it runs out through poor performance, you are guaranteed to have a lifetime income, as long as you don’t take out more than the plans recommended income (this recommended income can also grow if the fund performs).

Other providers essentially buy an annuity with part of your fund and offer the rest as a flexibly accessed drawdown pot.

There are occasions if you take out more than the recommended amount, that the plan won’t provide a lifetime income. It’s therefore important you fully understand these plans before opting in.

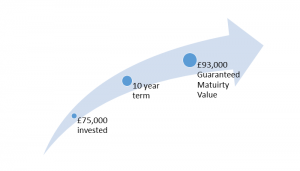

Fixed Term Drawdown with Guaranteed maturity value.

The official name for this is a fixed term annuity, but it’s not an annuity. It’s actually a form of drawdown and follows the same regulatory rules.

At the outset you decide how much income is required per year and over what term. Once these two options are chosen a guaranteed maturity amount is provided on day one.

This is the figure you are guaranteed to receive back at the end of your chosen term.

It is not exposed to investment funds and therefore won’t fluctuate or incur any ongoing charges.

The rate of growth which is applied to the fund will be based on the term chosen. This is usually similar to deposit based interest.

These are generally for people who don’t want to tie their money up in an annuity, but don’t want the investment risk of income drawdown.

They provide a known income for a known term with a known outcome.

As drawdown develops for the mass market, providers will continue to innovate and offer something for everyone. The downside to this is too much choice. For those reaching retirement there is a feeling of ‘where do I start!’.

Drawdown with guarantees offers a solution for those who don’t wish to tie their funds up in annuities and may wish to pass assets onto their estate. Inevitably there is a trade off, either through increased cost or performance restrictions.

[…] 3 Drawdown solutions with guarantees […]